1) Definition

Requesting a refund from the card-issuing bank at the request of the card user to the owners

2) Examples

- When there is a question about the identity of the card user (theft or lost card)

- When there is a demand by the card user (when the customer can not remember the used item

- When there is a mistake of the employer and the employee (when the card is read by duplication)

- When there is doubt about the validity of the card

3) 3) Chargeback prevention

- All receipts must be retained for 2 years (18 months for MasterCard and 6 months for visa)

- Make sure that the signature and name on the back of the card match the sign and name of the receipt.

- When ordering by phone, use Imprinter Slip to check the ID. The Imprinter Slip is used in emergency situations such as machine breakdown, telephone order, etc. In this case, the discount rate increases by 0.3% because of the increased risk.

- Do not sell 100% if you touch the machine to the customer or manipulate the machine by your instructions (Ticket Only, Force function).

- For Manual Sale (Key-In), if the card is on-site, create an Imprint slip and sign both the credit card receipt and the Imprint receipt.

- If the card is not in the field, please check if the AVS / Customer Code's Response Code is matched

- In particular, when you order a call from out of the country, obtain a certificate of transaction such as Authorization Form, Shipping & Delivery Slip, and Purchase Order.

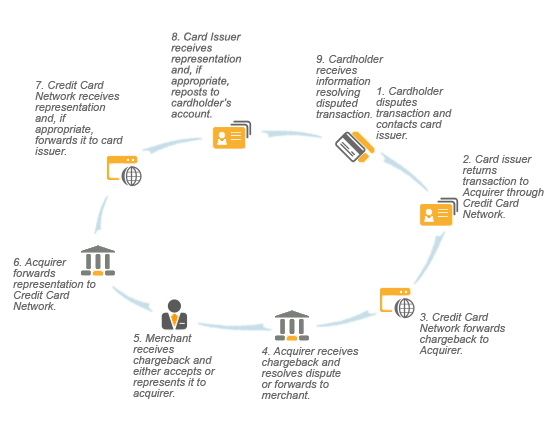

4) 4) Chargeback procedure

Step 1: Retrival Request

You must fax or mail a clear receipt copy before the deadline indicated in the Request Letter by asking the card issuer or card issuing bank to confirm receipt copy, and you will receive the result after 72 hours from the deadline.

Step 2: Chargeback

The step where the payment is withdrawn at the request of the card issuing bank and the amount is held. Sends various transaction data before the deadline indicated in Chargeback Notice.

Step 3: Pre-Arbitration(VISA) , Second Chargeback (Master Card)

In the first chargeback phase, the payment that we requested is rejected

Step 4: Arbitration

1.2 Chargeback Result The arbitration committee is the process of judging the legitimacy of card settlement. One of the owner and the card owner will bear the cost of the trial ($ 500).